NewsGate Press Network

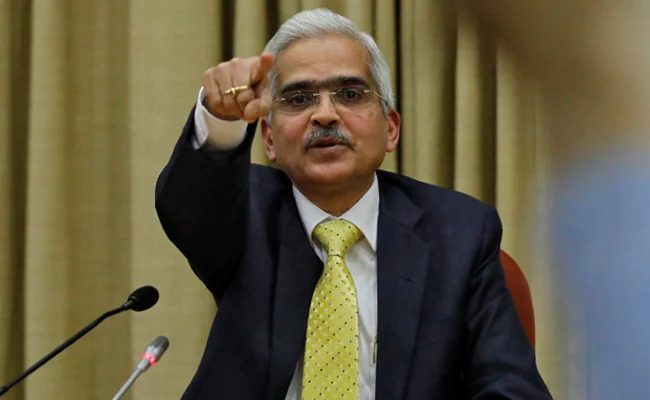

The Reserve Bank of India Governor Shaktikanta Das on Wednesday said RBI remains nimble and flexible in its liquidity management operations to meet the requirements of the productive sectors of the economy.

Therefore, although the Reserve Bank remains in absorption mode, we are ready to inject additional cash through Liquidity Adjustment Facility (LAF) operations if need arises.

In doing so, however, we will look for a durable sign of a turn in the liquidity cycle when banks draw down large part of their standing deposit facility (SDF) and variable rate reverse repo (VRRR) balances., he added.

The Reserve Bank remains committed to flexibility and two-sidedness in liquidity operations, but market participants must wean themselves away from the overhang of liquidity surpluses.

Das further said in the period ahead, liquidity conditions are likely to improve due to several factors which would include moderation in currency in circulation in the post-festival period, pick up in government expenditure in the last few months of the financial year and higher forex inflows due to the return of portfolio investors.

Tax outflows and currency demand do produce transient episodes of tight liquidity, but a holistic view needs to be taken, he added.

Comments are closed for this post.